Bonding insurance is a crucial aspect of the construction industry that often gets misunderstood. While many believe they understand its purpose, several myths cloud the reality of what bonding insurance truly entails. This article aims to demystify these misconceptions and provide clear insights into bonding insurance, particularly within the construction domain.

Understanding Bonding Insurance Construction

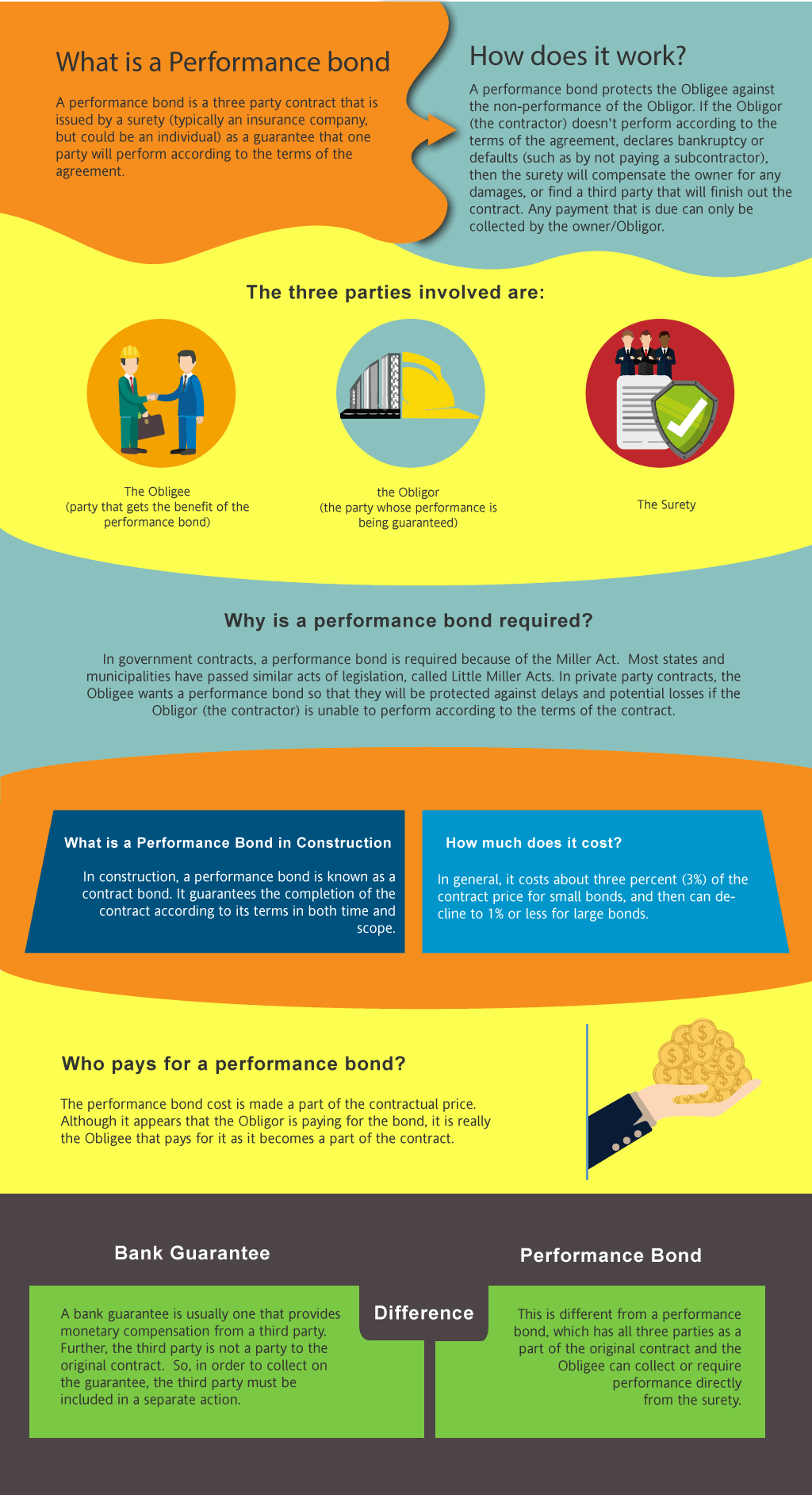

Before diving into the common myths, it’s essential to understand what bonding insurance in construction really is. In essence, bonding insurance is a guarantee that protects project owners against financial loss if a contractor fails to fulfill their contractual obligations.

What Is Bonding Insurance?

Bonding insurance comprises three primary types:

Bid Bonds: These are required during the bidding process to ensure that the contractor will honor their bid. Performance Bonds: These protect project owners by guaranteeing that contractors will complete their work according to the contract terms. Payment Bonds: These ensure that subcontractors and suppliers are paid for their services and materials.In construction, bonding insurance serves as a safety net, ensuring that projects proceed smoothly without financial hiccups due to contractor defaults.

Why Is Bonding Insurance Important?

The importance of bonding insurance cannot be overstated. It instills confidence in clients and stakeholders, making them more likely to invest in or hire bonded contractors. Moreover, it serves as a risk management tool for project owners.

Common Myths About Bonding Insurance Debunked

When discussing bonding insurance in construction, various myths can lead to confusion and misinformed decisions. Here are some of the most common misconceptions.

Myth 1: Bonding Insurance Is Just Another Expense

Many believe that bonding insurance is merely an additional cost without any tangible benefits. However, this couldn’t be further from the truth.

Reality Check

While it’s true that there’s a premium associated with obtaining bonding insurance, the financial protection it offers far outweighs this cost. In case of contractor default, project owners can recover losses through claims made against performance or payment bonds.

Myth 2: All Contractors Are Automatically Bonded

Another prevalent myth is that all contractors are bonded simply because they operate in the construction industry.

Reality Check

Not all contractors pursue bonding as it involves meeting specific qualifications and financial assessments. Clients need to verify whether a contractor holds valid bonds before proceeding with contracts.

Myth 3: Bonding Insurance Guarantees Project Success

Some assume that having bonding insurance guarantees successful project completion without issues.

Reality Check

While bonding does provide security against certain risks, it doesn’t eliminate all potential problems on-site. Issues such as delays or quality concerns can still arise despite having bonded contractors.

Understanding Different Types of Bonds in Construction

To better grasp how bonding works, let’s delve deeper into different types of bonds used within the construction sector.

Bid Bonds Explained

Bid bonds serve as a safety measure during the bidding phase.

- They assure project owners that if awarded the contract, the winning bidder will proceed with fulfilling their obligations. If not honored, project owners receive compensation up to a specified amount.

Performance Bonds Explained

Performance bonds guarantee that contractors will complete their projects per contractual terms.

- They protect against non-completion or failure to meet specifications. If a contractor defaults, funds from the bond can cover hiring another contractor to finish the job.

Payment Bonds Explained

Payment bonds ensure all parties involved in a project get compensated for their surety bonds for contractors work.

- They protect subcontractors from non-payment by general contractors. This ensures smooth cash flow throughout the project's life cycle.

Why Do Myths Surround Bonding Insurance?

Misunderstandings about bonding stem from various factors:

Lack of Awareness: Many individuals are unaware of how bonding works and its significance. Industry Jargon: Technical language can alienate those unfamiliar with industry norms. Anecdotal Experiences: Personal stories often fuel misconceptions when they may not reflect broader realities.The Role of Underwriters in Bonding Insurance Construction

Underwriters play a critical role in determining eligibility for bonding insurance by assessing risk factors associated with contractors’ capabilities and finances.

How Do Underwriters Assess Risk?

Underwriters evaluate several elements:

- Financial statements Past performance on similar projects Credit history

This comprehensive analysis helps determine whether or not a contractor qualifies for specific bonds—ultimately protecting both clients and professionals involved in construction projects.

The Impact of State Regulations on Bonding Insurance

State regulations significantly influence how bonding operates within individual jurisdictions. Understanding these local laws is vital for ensuring compliance while maximizing coverage benefits effectively across state lines.

Why Are Regulations Necessary?

Regulations help establish standards ensuring that only competent contractors obtain bonds while also protecting consumers from potential fraud or negligence during projects undertaken by unqualified entities operating without oversight mechanisms established beforehand—thus promoting overall industry integrity!

Common Misconceptions Regarding Costs Associated With Bonds

A significant concern among potential clients revolves around costs tied directly into purchasing necessary forms of bond coverage prior engaging any contracted work proceeding forward; however addressing these fears is imperative here too!

Are Higher Premiums Always Better?

It's tempting to think higher premiums equate improved service levels; however this isn't always accurate! Rather than focusing solely upon price points alone consider evaluating available options based upon your specific needs instead—as lower-priced policies may adequately cover risks posed while still offering peace-of-mind assurance needed throughout duration involved!

FAQ Section

Here are some frequently asked questions regarding bonding insurance:

What Is The Purpose Of A Bid Bond?

A bid bond ensures that if you win a contract based on your bid proposal but fail to execute it accordingly afterward then you’ll incur penalties which could include paying up lost funds back toward original party who sought out bids initially—with amounts varying depending upon terms!

How Does A Performance Bond Work?

A performance bond comes into play when an owner believes there might be chances something goes awry during execution phase—offering recourse so they’re protected should delays occur due unforeseen circumstances arising unexpectedly along way!

Can Subcontractors Get Their Own Payment Bonds?

Yes! Subcontractors can secure payment bonds independently enabling them safeguard payments owed specifically towards work performed without relying entirely upon general contractor securing coverage alone too!

How Do I Know If My Contractor Is Properly Bonded?

Always ask prospective contractors directly about certifications held—inquire whether documentation exists verifying active status regarding required licenses/registration—and don’t hesitate reaching out appropriate agencies verify authenticity claims made therein before proceeding further too!

What Happens If A Contractor Defaults On Their Contract?

Should a situation arise where default occurs then affected parties may file claims against respective performance/payment bonds seeking recovery remedies available under law governing breach thereof thereby minimizing losses incurred throughout process altogether effectively reducing impact felt across board overall too!

li21/ol3/hr8hr8/##

Conclusion

Understanding binding insurance's nuances within constructions reveals its critical role safeguarding interests across entire industry spectrum—from independent tradespeople striving secure livelihoods through responsible practices down large-scale developers maneuvering complexities navigating regulatory landscapes ahead alike! By debunking common myths surrounding this topic we hope foster awareness encouraging informed decision-making processes leading positive growth outcomes benefiting everyone involved long-term ultimately improving standards observed along way too!

So next time you're considering contracting services remember: don't let myths cloud judgment; do your research instead—ensure proper protections are put place well ahead start journey toward realizing dreams built solid foundations laid right first time round every single time thereafter too!!